The Social Media Battleground of 2026

In 2026, New Zealand’s digital landscape is experiencing one of its most competitive eras, a battle between two social media powerhouses. Instagram and TikTok. With over 4.3 million active social media users in NZ, brands, influencers, and marketers continuously adapt to shifting trends, engagement patterns, and algorithm updates.

While Instagram has long dominated with visual storytelling and influencer-driven content, TikTok’s short-form video model is redefining how Kiwis consume and create content. The question is no longer which platform is popular but which platform will drive the most real engagement and growth in 2026.

Explores New Zealand’s latest social media statistics, growth trends, audience demographics, and engagement insights by comparing Instagram and TikTok side-by-side. We’ll also uncover how AI-targeted strategies and smart follower acquisition through BuyFollowersNZ are helping creators and brands achieve meaningful, fast, and sustainable social growth in this new era.

The State of Social Media in New Zealand

Key Social Media Usage Statistics NZ 2026

- Total Social Media Users: 4.3 million (approx. 87% of the total population)

- Average Daily Time Spent: 2 hours 32 minutes

- Top Platforms by Popularity:

- Facebook: 77%

- Instagram: 64%

- TikTok: 59%

- LinkedIn: 38%

- X (formerly Twitter): 17%

The gap between Instagram and TikTok continues to shrink. TikTok has seen a 12% increase in users since 2026, compared to Instagram’s 6% growth.

Platform-Specific Engagement Trends

- Instagram continues to dominate brand visibility and influencer marketing. Its strongest demographics are users aged 25-34, with content formats like Reels and Stories driving most impressions.

- TikTok leads in average engagement rate (5.8%), especially among younger users (16-24). Its algorithm rewards creativity, trends, and authentic user interaction rather than just follower count.

Why These Trends Matter for Marketers

Understanding these numbers for businesses and creators in New Zealand isn’t just about tracking popularity; it’s about identifying where your target audience lives, scrolls, and converts.

In 2026, AI-driven targeting and audience segmentation will be key to effectively leveraging these platforms.

With services like BuyFollowersNZ, marketers can enhance visibility and engagement by connecting with real, smart-targeted users who align with their brand niche.

Instagram’s Ongoing Influence

Instagram remains one of the most powerful social media platforms in New Zealand. As of 2026, it boasts an estimated 2.8 million active users, representing over 64% of the population. Despite competition from TikTok, Instagram has successfully reinvented itself through AI-driven recommendations, Reels, and enhanced e-commerce integrations, keeping users and brands deeply engaged.

Around 70% of Kiwi brands now run regular Instagram campaigns, a 9% increase since 2023.

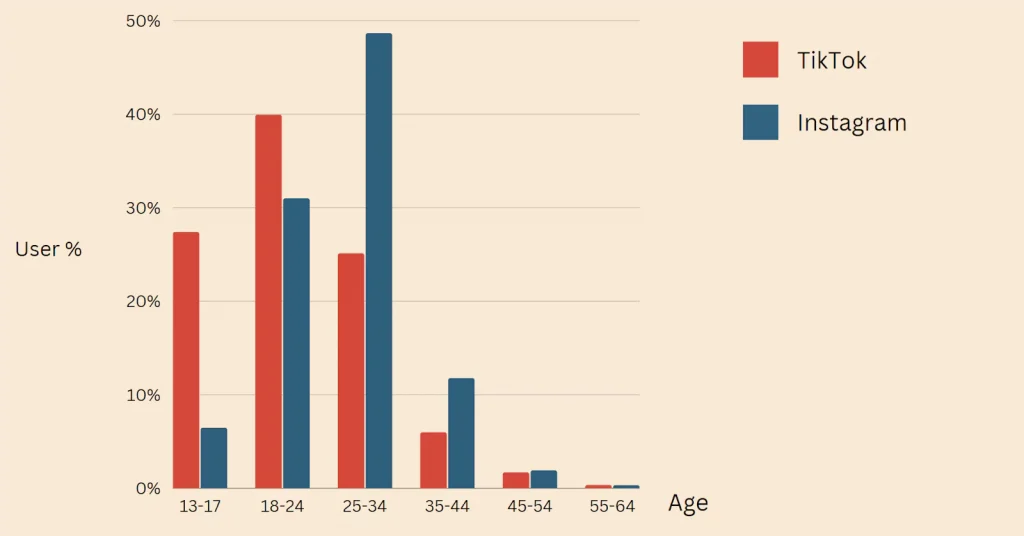

Instagram User Demographics NZ 2026

Instagram’s audience in New Zealand continues to diversify:

- Age Groups:

- 18-24 years: 31%

- 25-34 years: 37%

- 35-44 years: 19%

- 45+ years: 13%

- Gender Split: 54% female, 46% male

- Location Insights: Auckland, Wellington, and Christchurch dominate user activity, with rapid growth from regional areas like Hamilton and Tauranga.

This demographic spread shows Instagram’s stronghold among young professionals and mid-level earners, a key audience for brands targeting lifestyle, fashion, and beauty segments.

Engagement Patterns and Content Preferences

Instagram’s shift to short-form video has completely transformed engagement in NZ.

- Average Engagement Rate: 2.9% (higher than the global average of 2.3%)

- Top Performing Formats: Reels (56% of total reach), Stories (27%), Carousel Posts (17%)

- Hashtag Use: Localized hashtags such as #NZStyle, #KiwiLife, and #NewZealandBeauty drive higher visibility and algorithmic favor.

The platform’s integration with AI-driven discovery means users now encounter more personalized content, allowing small businesses and creators to grow faster even with modest budgets.

Instagram for Business & Influencers

Instagram remains a go-to channel for brand storytelling and influencer partnerships.

- 68% of NZ businesses say Instagram drives their strongest ROI in social campaigns.

- Over 50% of users report purchasing a product after seeing it on Instagram.

- Micro-influencers (5K-50K followers) are the most trusted segment for brand collaborations.

Local brands like GlowLab and Moana Road leverage influencer partnerships and user-generated content to build trust and authenticity among Kiwi consumers.

AI Targeting & Smart Growth Solutions

In 2026, growth on Instagram is not just about posting more; it’s about targeting smarter.

AI-powered algorithms prioritize genuine engagement signals (saves, shares, comments) over raw likes, making audience quality more critical than ever.

That’s where BuyFollowersNZ stands out: it offers AI-targeted Instagram growth services that connect users with real NZ-based followers who align with their niche. Whether you’re a local business, creator, or influencer, AI-based smart targeting helps you achieve steady, authentic growth while maintaining algorithmic trust.

Pro Tip: In 2026, combine an organic content strategy with AI-targeted followers and engagement boosts from BuyFollowersNZ to maximize reach, engagement, and visibility.

TikTok’s Unstoppable Rise

TikTok’s dominance in New Zealand continues to surge in 2026, reshaping the digital landscape for users and brands. With over 1.8 million active users, TikTok has captured the attention of Gen Z and Millennials who crave quick, entertaining, and authentic content.

In 2024, TikTok’s user base grew by nearly 21%, making it New Zealand’s fastest-growing social media platform.

Its unique algorithm, which personalizes the For You Page (FYP) based on behavior and interest signals, allows even new creators and small businesses to go viral overnight.

TikTok User Demographics NZ 2026

TikTok’s audience base is youthful, vibrant, and trend-driven:

- Age Breakdown:

- 13-17 years: 22%

- 18-24 years: 34%

- 25-34 years: 29%

- 35+ years: 15%

- Gender Distribution: 58% female, 42% male

- Top Regions: Auckland leads in activity, followed by Wellington, Christchurch, and Dunedin.

TikTok’s reach is expanding beyond entertainment. It’s now a hub for education, product discovery, and brand storytelling, making it a critical channel for businesses aiming to connect emotionally with Kiwi audiences.

TikTok Engagement & Content Preferences

When it comes to engagement, TikTok leaves all competitors behind.

- Average Engagement Rate in NZ: 5.96% (highest among all major platforms)

- Top Content Types:

- Trending challenges (33%)

- Product reviews & mini-vlogs (28%)

- Educational or “how-to” clips (21%)

- Brand UGC collaborations (18%)

Unlike Instagram, TikTok rewards spontaneity and authenticity. Kiwi creators who share unfiltered, relatable videos often outperform polished campaigns, emphasizing realness over perfection.

Local creators like Jazz Thornton and Johnny Tuivasa-Sheck use TikTok to amplify awareness and storytelling, creating community-driven conversations.

TikTok for Businesses & Creators

Brands in New Zealand are fast recognizing TikTok’s power as a marketing engine.

- 72% of NZ marketers plan to increase their TikTok ad budget in 2026.

- TikTok Shop and in-app purchasing features are helping brands drive direct conversions.

- 48% of NZ TikTok users say they’ve bought something after seeing it on the platform.

This shift toward social commerce means TikTok is no longer just about entertainment; it’s a serious business tool influencing real buying decisions.

Smart Real Targeting & AI Growth

TikTok’s algorithm thrives on data and personalization, making AI-driven audience targeting the future of growth.

Creators and brands leveraging AI-powered engagement tools achieve better reach, consistent visibility, and stronger community connections.

That’s where BuyFollowersNZ becomes a game-changer. Their TikTok growth solutions use Smart Real Targeting to deliver authentic NZ-based followers, likes, and views that align with your niche. Unlike random boosts, these services are algorithm-safe, improving your organic ranking and visibility on the FYP.

Pro Tip: In 2026, combine high-performing TikTok trends (like duets or local challenges) with BuyFollowersNZ’s Smart Targeting tools to grow your brand quickly and authentically.

Engagement & Content Dynamics

TikTok excels in highly interactive short-video formats, where users engage more deeply and for longer. For example, globally, TikTok users spend more time per session than Instagram users. In contrast, Instagram’s strength lies in its diverse content ecosystem, from posts and carousels to Stories and Reels, making it a go-to for brands, influencers, and lifestyle content in NZ.

Which Platform Is Best For What?

- Best for brand storytelling & influencer collaborations: Instagram leads. Its established ecosystem is ideal for curated visuals, lifestyle branding, and long-term campaigns.

- Best for rapid growth and viral exposure: TikTok wins. Its algorithm heavily rewards creativity, trend participation, and authentic content, making it ideal for fast discovery.

- Best for business conversions in NZ 2026: It depends on your goals. Instagram may give reliable ROI for known brands; TikTok offers breakout opportunities for newer entrants or trend-driven campaigns.

Strategic Implications for NZ Creators & Marketers

For creators and small businesses in New Zealand, understanding the comparison means adapting strategy:

- If your audience is 18-34 and you favour storytelling and polished content, invest in Instagram growth, supported by targeted tools and services.

- To capture younger users, go-viral, or lean into trend-based content, prioritise TikTok.

- A hybrid strategy often works best: use Instagram for brand building and community, and TikTok for awareness and fast growth.

Taking Action with AI-Driven Tools

Growth in 2026 is no longer purely organic. With both platforms favouring “real engagement” (comments, shares, saves) and demoting inauthentic reach, leveraging AI-driven targeting is becoming a competitive advantage.

For instance, platforms like BuyFollowersNZ offer services tailored to Instagram and TikTok, supplying real, niche-aligned followers, likes, and views that fit the NZ market. By combining platform-specific strategies with innovative growth tools, creators and marketers can tilt the game in their favour.

1. What is the most popular social media platform in New Zealand in 2026?

Over 88% of New Zealanders aged 18+ use social media, with Instagram reaching about 2.5 million users in early 2026. However, TikTok is catching up fast in younger age brackets, making popularity relative to the audience segment.

2. Is TikTok more popular than Instagram in NZ in 2026?

While Instagram still has a larger overall user base in NZ (2.5 million in early 2026), TikTok’s growth rate and engagement among younger users are outpacing it, especially among Gen Z.

3. How fast is Instagram growing in New Zealand in 2026?

Instagram’s potential ad reach in NZ increased by about 4.2% between October 2024 and January 2026. Growth via organic reach alone is slowing, so brands are turning to more innovative growth tools.

4. What age group uses TikTok the most in NZ in 2026?

TikTok leads among 18-24-year-olds in many markets, and NZ data shows strong uptake among 18-34-year-olds. This makes TikTok a go-to platform for younger audiences in NZ.

5. Can AI help increase Instagram followers in 2026?

Yes. Given that Instagram’s algorithm now prioritizes engagement metrics over follower count, leveraging AI-based targeting to reach real, niche followers will help boost visibility and growth in 2026.

6. What is smart real targeting in social media growth?

Smart real targeting means acquiring genuine followers, likes, and views aligned with your niche and geography (e.g., NZ), rather than fake or generic accounts. This builds long-term engagement and algorithm credibility.

7. How do NZ businesses benefit from Instagram and TikTok marketing in 2026?

NZ brands using Instagram and TikTok can reach high-value audience segments, leverage short-form content for awareness (TikTok) or curated storytelling (Instagram), and convert followers into customers through social commerce integrations.

8. Which platform offers better ROI for NZ marketers in 2026?

TikTok offers higher engagement and viral potential, making it strong for awareness campaigns. Instagram offers more established ad infrastructure and community for longer-term brand building. The best ROI depends on your goal.

9. Is buying followers safe for Instagram and TikTok growth?

Buying followers is risky if they are fake or bots. However, if the service uses AI-targeted, real, and niche-engaged followers (especially NZ-based), it can support authentic growth and maintain algorithm trust.

10. How long does it take to see results from social media growth efforts in NZ 2026?

With consistent posting, engagement tactics, and targeted follower growth tools, many creators see meaningful traction within 4-8 weeks. For full audience scale and meaningful conversions, allow 3-6 months.